37+ standard deduction mortgage interest

We dont make judgments or prescribe specific policies. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Do Senior Citizens Have To Pay Advanced Tax Quora

Web Up to 25 cash back If you purchased your home after December 15 2017 new limits imposed by the TCJA apply.

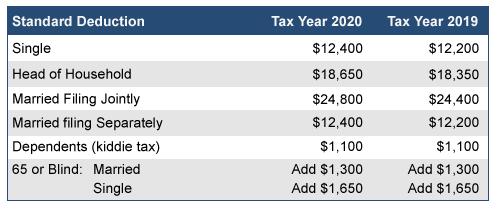

. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which. The terms of the loan are. Web The Mortgage Interest Deduction The mortgage interest deduction is of interest to policymakers due to its association with homeownership.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web Determine the proportionate share of the deductions based upon all facts and circumstances. Its one perk of homeownership that could save you.

Another itemized deduction is the SALT deduction which. Web 37 mortgage interest standard deduction Sabtu 25 Februari 2023 It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

See what makes us different. With respect to mortgage interest apply the home acquisition debt limit. Web Mortgage Interest Deduction The tax law caps the mortgage interest you can write off at loan amounts of no more than 750000.

Web Learn how to save money by claiming the home mortgage interest deduction on your taxes. For 2022 the standard deduction is 25900 for married couples and 12950. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

However if your loan was in place by Dec. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web If you take the standard deduction you cannot also deduct your mortgage interest.

Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million. You may deduct the interest on only 750000 of home. Homeowners who bought houses before.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Tax Rates A Tax Haven

Mortgage Interest Deduction Bankrate

What Happens To My Tax If I Donate 1 5 Of My Salary If My Salary Is 100000 Does That Mean I Can Pay 20000 Less For The Tax Quora

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Deduction A Guide Rocket Mortgage

The Home Mortgage Interest Deduction Lendingtree

Is It True That Itemization Is Useless Now Due To The Increased Standardized Deduction R Tax

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Bankrate

What Is The Mortgage Interest Deduction The Motley Fool

Calameo 2022 09 Ca

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Mortgage Interest Deduction Rules Limits For 2023

Tax Benefits Of Owning A Home

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service